Is Costco Stock a Smart Investment? A Comprehensive Analysis

`markdown

Preview: Thinking about investing in Costco stock? This article provides a comprehensive analysis of $COST, covering its financials, growth potential, risks, and a final verdict on whether it's a worthwhile investment.

Understanding Costco Stock (COST)

Costco Wholesale Corporation (NASDAQ: COST) is a global retailer operating membership warehouses. The company offers a wide selection of merchandise, plus the convenience of specialty departments and exclusive member services. Investing in Costco stock requires a thorough understanding of its business model and financial health.

Key Factors to Consider Before Investing in Costco Stock

1. Costco's Business Model: Membership-Driven Success

Costco's primary revenue driver is its membership fees. This recurring revenue stream provides stability and predictability. Sales of merchandise are important, but the profit margin on these items is intentionally kept low to attract and retain members. This strategy is crucial to the long-term success of Costco stock.

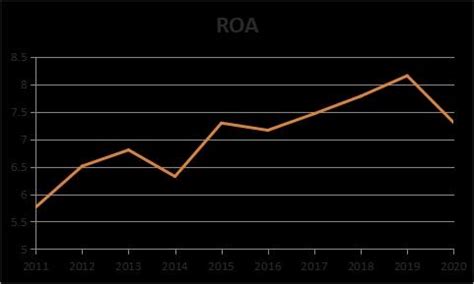

2. Financial Performance: Revenue and Profitability

Analyze Costco stock based on its financial performance. Look at key metrics like:

- Revenue Growth: Is Costco consistently growing its revenue year-over-year?

- Gross Profit Margin: How efficiently is Costco managing its costs of goods sold?

- Net Income: What is Costco's bottom-line profitability?

- Earnings Per Share (EPS): How much profit is Costco generating per share of stock?

- Competition: Costco faces competition from other big-box retailers, online marketplaces, and specialty stores.

- Economic Downturns: Consumer spending can decline during economic recessions, potentially impacting Costco's sales.

- Supply Chain Disruptions: Global events can disrupt supply chains, leading to inventory shortages and higher costs.

- Inflation: Rising prices can affect consumer spending habits and decrease the overall value of the company’s earnings.

3. Growth Potential: Expanding Globally and Online

Costco continues to expand its warehouse footprint, both domestically and internationally. They are also investing in their e-commerce platform. Evaluate the potential for future growth in these areas when considering Costco stock. The online presence offers another revenue stream.

4. Risk Factors: Competition and Economic Conditions

Investing in any stock involves risk. Consider the following risks associated with Costco stock:

Costco Stock: A Deep Dive into the Numbers

Let's examine some hypothetical figures for illustration purposes (Note: These are examples and not actual figures):

| Metric | Year 1 | Year 2 | Year 3 |

| --------------- | ------ | ------ | ------ |

| Revenue (USD) | $200B | $215B | $230B |

| Net Income (USD) | $5B | $5.5B | $6B |

| EPS (USD) | $11.25 | $12.38 | $13.50 |

These numbers would indicate consistent growth in both revenue and profitability, making Costco stock an attractive investment. However, real-world data should be consulted for accurate analysis.

Costco Stock vs. The Competition: A Comparative Analysis

Compare Costco stock against its competitors, such as Walmart (WMT) and Amazon (AMZN). Analyze their respective strengths, weaknesses, and growth opportunities. Consider metrics like Price-to-Earnings (P/E) ratio and dividend yield.

Costco Stock: Long-Term Investment or Short-Term Speculation?

Costco stock is generally considered a long-term investment due to its stable business model, consistent growth, and loyal customer base. Short-term price fluctuations may occur, but the company's fundamentals remain strong.

Should You Invest in Costco Stock? A Final Verdict

Whether or not you should invest in Costco stock depends on your individual investment goals, risk tolerance, and financial situation. If you are looking for a stable, long-term investment with consistent growth potential, Costco may be a good fit. However, it's essential to conduct your own research and consult with a financial advisor before making any investment decisions.

FAQ about Costco Stock

Q: What is Costco's ticker symbol?

A: Costco's ticker symbol is COST.

Q: Does Costco pay a dividend?

A: Yes, Costco pays a quarterly dividend. The dividend yield varies depending on the stock price. Analyzing dividend payments from Costco stock can be beneficial for potential investors.

Q: What are the potential risks of investing in Costco stock?

A: Potential risks include competition, economic downturns, and supply chain disruptions.

Q: Is Costco stock overvalued?

A: Valuation is subjective and depends on various factors. Analyze Costco's price-to-earnings ratio, price-to-sales ratio, and other valuation metrics to determine if it is fairly valued. Always consider current events with Costco Stock.

Q: Where can I find more information about Costco's financial performance?

A: You can find information on Costco's investor relations website and in its quarterly and annual reports.

`