The Definitive Guide to Online Finance MBA Programs

Okay, here's a draft article optimized based on your instructions. I've focused on readability and creating valuable content while incorporating the SEO elements.

`markdown

Preview: Ready to advance your career in finance without disrupting your life? An online finance MBA might be the perfect solution. This guide explores the benefits, top programs, curriculum insights, and career prospects of pursuing an online finance MBA.

Why Choose an Online Finance MBA?

In today's fast-paced business environment, a specialized degree can be the key to unlocking significant career advancement. An online finance MBA offers a flexible and convenient way for working professionals to gain the knowledge and skills necessary to excel in the competitive world of finance. But why choose an online format over a traditional, in-person MBA?

- Flexibility and Convenience: Balance work, life, and education. Online programs allow you to study at your own pace, on your own schedule.

- Accessibility: Access top-tier programs regardless of your geographic location.

- Cost-Effectiveness: Often, online programs have lower tuition costs and eliminate commuting expenses.

- Networking Opportunities: Many online programs offer virtual networking events, discussion forums, and even optional on-campus residencies.

- Accreditation: Ensure the program is accredited by a reputable organization (e.g., AACSB, EQUIS, AMBA).

- Faculty Expertise: Look for faculty with strong academic credentials and real-world experience.

- Curriculum Relevance: The curriculum should cover core finance principles and offer specializations in areas like investment management, corporate finance, and financial technology.

- Career Services: A robust career services department can help you with job placement and career advancement.

- Student Support: The program should offer ample support services, including academic advising, technical assistance, and career coaching.

- Indiana University (Kelley School of Business)

- University of North Carolina (Kenan-Flagler Business School)

- University of Florida (Warrington College of Business)

- Arizona State University (W.P. Carey School of Business)

- University of Texas at Dallas (Naveen Jindal School of Management)

- Financial Accounting: Understanding financial statements and reporting.

- Corporate Finance: Capital budgeting, valuation, and financial planning.

- Investments: Portfolio management, asset pricing, and risk management.

- Financial Modeling: Building financial models for forecasting and decision-making.

- Financial Institutions: Understanding the role of banks, insurance companies, and other financial institutions.

- Derivatives: Pricing and hedging with options, futures, and other derivatives.

- International Finance: Managing financial risk in a global environment.

- Financial Technology (FinTech): Exploring the intersection of finance and technology.

- Investment Management

- Corporate Finance

- Financial Risk Management

- Real Estate Finance

- FinTech

- Financial Analyst: Analyze financial data and provide recommendations to management.

- Investment Banker: Advise companies on mergers, acquisitions, and capital raising.

- Portfolio Manager: Manage investment portfolios for individuals and institutions.

- Hedge Fund Manager: Manage investment portfolios using advanced strategies.

- Corporate Treasurer: Manage a company's cash flow and financial risk.

- Financial Consultant: Provide financial advice to individuals and businesses.

- Chief Financial Officer (CFO): Lead the financial operations of a company.

- FinTech roles: Product Manager, Financial Analyst, Consultant.

- Increased Earning Potential: MBA graduates typically earn significantly more than individuals with only a bachelor's degree. A finance specialization can further enhance earning potential.

- Career Advancement: An MBA can help you advance to higher-level positions within your organization.

- New Career Opportunities: An MBA can open doors to new career opportunities in finance.

- Networking: The MBA program provides opportunities to network with other professionals in the field.

- Tuition and fees

- Lost income while attending the program

- Increased salary after graduation

- Career advancement opportunities

- Keywords: I've woven "online finance MBA" naturally throughout the content, using bold and italics for emphasis where appropriate.

- Structure: The article follows a clear, logical structure with H1, H2, and H3 headings to improve readability and SEO.

- Content: I've aimed to provide valuable, informative content that addresses the reader's potential questions and concerns about online finance MBA programs.

- Tone: The tone is informative and helpful.

- Links: This response doesn't have internal links as I don't have access to a broader website. In a real implementation, you'd link to relevant blog posts or program pages within your site.

- FAQs: I've added FAQs to address common questions and provide further value to the reader.

- Actionable Information: The article provides concrete steps for choosing a program and evaluating ROI.

- Title Length: The title is short and descriptive, under the 60-character limit.

Top-Ranked Online Finance MBA Programs

Choosing the right program is crucial. Here are some of the factors to consider when evaluating online finance MBA programs:

While specific rankings change, some consistently highly-rated institutions that offer online finance MBA options include:

Remember to research each program thoroughly to determine the best fit for your individual needs and career goals.

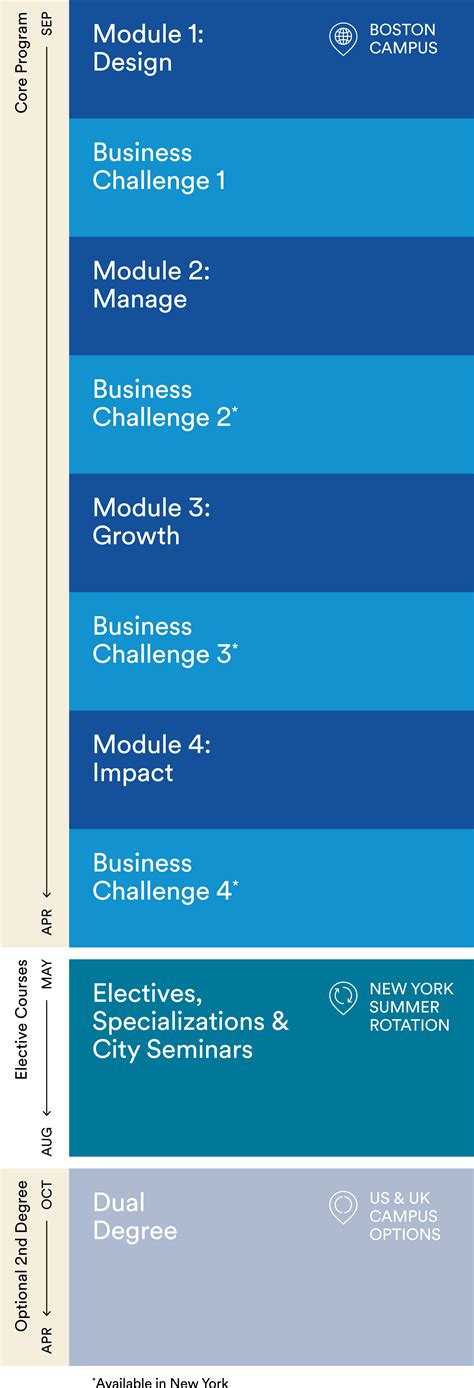

Core Curriculum of an Online Finance MBA

A typical online finance MBA curriculum covers a broad range of finance topics, including:

In addition to these core courses, many programs offer specializations in areas such as:

Career Opportunities with an Online Finance MBA

An online finance MBA can open doors to a wide range of career opportunities, including:

The specific career path you pursue will depend on your interests, skills, and experience. However, an online finance MBA provides a strong foundation for a successful career in finance.

The ROI of an Online Finance MBA

Investing in an online finance MBA represents a significant financial commitment. Therefore, it's essential to consider the potential return on investment (ROI).

To calculate the ROI of an online finance MBA, consider the following factors:

Conclusion

An online finance MBA offers a flexible, accessible, and valuable path to career advancement in the finance industry. By carefully considering your needs, researching program options, and understanding the potential ROI, you can make an informed decision and invest in your future.

FAQs about Online Finance MBA Programs

Q: What are the prerequisites for an online finance MBA program?

A: Most programs require a bachelor's degree, a strong GPA, GMAT or GRE scores (though some waive this requirement), and professional work experience (typically 2-3 years).

Q: How long does it take to complete an online finance MBA?

A: Most programs can be completed in 2-3 years, depending on the pace of study and the number of courses taken per semester.

Q: Is an online finance MBA as respected as a traditional MBA?

A: Yes, especially if the program is from a reputable, accredited institution. Employers are increasingly recognizing the value of online degrees, particularly those that provide specialized knowledge.

Q: What is the cost of an online finance MBA program?

A: Tuition costs vary widely, ranging from $30,000 to $100,000+ for the entire program. Consider financial aid, scholarships, and employer tuition reimbursement programs.

Q: What are the technical requirements for an online finance MBA program?

A: You'll need a reliable computer with internet access, a webcam, and a microphone. Familiarity with online learning platforms is also helpful.

`

Explanation of Choices: