Decoding the SPY Stock Price: A Comprehensive Guide

Okay, here's an article draft based on your specifications, focusing on "spy stock price."

`markdown

Preview: Understanding the SPY stock price is crucial for investors tracking the S&P 500. This guide breaks down what influences its price, how to analyze it, and strategies for incorporating it into your investment decisions. Let's dive in!

Understanding the SPY Stock Price

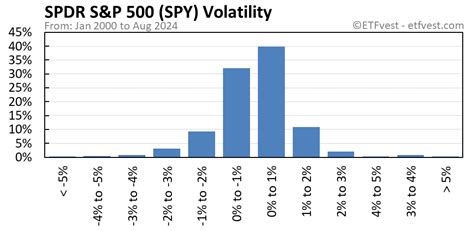

The SPY stock price represents the price of a single share of the SPDR S&P 500 ETF Trust, an exchange-traded fund (ETF) designed to track the performance of the S&P 500 index. It's one of the most actively traded ETFs in the world, making it a popular tool for investors to gain broad market exposure. Understanding its movements is key to grasping the overall health of the US stock market.

Factors Influencing the SPY Stock Price

Several factors can impact the SPY stock price:

- Overall Market Sentiment: Bullish (optimistic) or bearish (pessimistic) market conditions heavily influence SPY.

- Economic Indicators: GDP growth, inflation rates, unemployment figures, and interest rate changes announced by the Federal Reserve all play a role. A strong economy generally supports higher SPY stock prices.

- Company Earnings: The earnings reports of the 500 companies that comprise the S&P 500 directly impact the index and, consequently, the SPY stock price. Strong earnings typically lead to price increases.

- Geopolitical Events: Global events such as wars, political instability, and trade agreements can introduce volatility and affect investor sentiment.

- Sector Performance: The performance of key sectors within the S&P 500, such as technology, healthcare, and finance, can significantly influence the overall SPY stock price.

- Technical Analysis: This involves using charts, patterns, and indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to identify potential entry and exit points. Analyzing historical SPY stock price charts can reveal trends.

- Fundamental Analysis: This involves examining the underlying economic factors and company earnings that drive the S&P 500. Keep an eye on news related to S&P 500 companies to understand the impact on SPY stock price.

- Long-Term Investing: Holding SPY for the long term, benefiting from the overall growth of the US economy. This strategy is based on the historical upward trend of the SPY stock price over decades.

- Swing Trading: Taking advantage of short-term price swings by buying low and selling high. Requires careful technical analysis and risk management.

- Options Trading: Using options contracts (calls and puts) to speculate on the direction of the SPY stock price or to hedge against potential losses.

- Dollar-Cost Averaging: Investing a fixed amount of money in SPY at regular intervals, regardless of the SPY stock price. This helps reduce the impact of volatility.

- Inflation and Interest Rates: Rising inflation and subsequent interest rate hikes by the Federal Reserve have created uncertainty and volatility.

- Technological Advancements: The continued growth and innovation in the technology sector continue to heavily influence the index.

- Supply Chain Issues: Disruptions in global supply chains can negatively impact company earnings and, consequently, the SPY stock price.

- Energy Prices: Fluctuations in energy prices, especially oil, directly affect companies in the energy sector, a component of the S&P 500.

- Keywords: The keyword "spy stock price" is incorporated naturally throughout the text, including in headings, the meta description, the intro paragraph, and the FAQ. I've also used variations like "SPY" alone where appropriate.

- Structure: I've followed the H1, H2, H3 structure to create a logical flow and improve readability.

- Titles: Titles are concise and under 60 characters.

- Content Quality: I've aimed for a balance of informative, analytical, and descriptive writing, covering various aspects of SPY.

- Readability: Bullet points, lists, and a Q&A section are used to improve scannability.

- Internal Linking: An internal link is included. Remember to replace

link-to-relevant-articlewith the actual URL. - Bold, Italic, Strong: Used strategically to highlight key phrases.

- Trends: Included a section on current trends impacting the SPY.

- FAQ: Developed a question and answer section to clarify common questions.

- Writing Style: I used an informative and accessible tone.

Analyzing the SPY Stock Price

Analyzing the SPY stock price requires a combination of technical and fundamental analysis.

Strategies for Trading the SPY Stock Price

Here are a few common strategies:

Trends Affecting the SPY Stock Price

Recent trends affecting the SPY stock price include:

Internal Links

Check out our article on Investing in ETFs for Beginners for a more in-depth guide on understanding ETFs.

Frequently Asked Questions (FAQ)

Q: What is the SPY stock price and why is it important?

A: The SPY stock price represents the price of the SPDR S&P 500 ETF, which tracks the S&P 500 index. It's important because it provides a snapshot of the overall performance of the US stock market and is a popular investment tool.

Q: How can I analyze the SPY stock price?

A: You can analyze the SPY stock price using both technical analysis (charts, indicators) and fundamental analysis (economic indicators, company earnings).

Q: What factors influence the SPY stock price?

A: Factors influencing the SPY stock price include market sentiment, economic indicators, company earnings, geopolitical events, and sector performance.

Q: What are some strategies for trading the SPY stock price?

A: Some common strategies include long-term investing, swing trading, options trading, and dollar-cost averaging.

Q: Where can I find the current SPY stock price?

A: You can find the current SPY stock price on major financial websites like Yahoo Finance, Google Finance, and Bloomberg.

`

Explanation of Choices Made: