Why is it Necessary to Include Your Family's Income and Tax Information on a FAFSA Application?

Okay, here's a markdown article draft optimized for the provided keyword and guidelines.

`markdown

Preview: Applying for financial aid for college can be daunting, and the FAFSA (Free Application for Federal Student Aid) is often the first step. Understanding why is it necessary to include your family's income and tax information on a FAFSA application is crucial to maximizing your aid eligibility. This article breaks down the reasons behind this requirement and what you need to know.

Understanding the FAFSA and Your Family's Financial Information

The Free Application for Federal Student Aid (FAFSA) is a form used by the U.S. Department of Education to determine a student's eligibility for federal student aid. This aid can come in the form of grants, loans, and work-study programs. But why is it necessary to include your family's income and tax information on a FAFSA application? The answer lies in determining your Expected Family Contribution (EFC), now known as the Student Aid Index (SAI).

Why is Family Income and Tax Information Required on the FAFSA?

- Determining Financial Need: The primary reason why is it necessary to include your family's income and tax information on a FAFSA application is to assess your family's ability to contribute to your education. This assessment is the foundation for calculating your financial need. The FAFSA uses a formula that considers income, assets, and other factors to arrive at an SAI.

- Fair Distribution of Funds: By collecting income and tax data, the government aims to distribute financial aid funds fairly to students who demonstrate the greatest need. This ensures that limited resources are allocated effectively.

- Verifying Information and Preventing Fraud: Including your family's income and tax information allows the Department of Education to verify the information provided on your application. This helps prevent fraud and ensures that aid is going to deserving students.

- Accessing Need-Based Aid: Many grants and scholarships are need-based. Accurate income information is essential to qualify for these types of aid. It's vital to understand that without providing this data, you risk missing out on significant financial assistance.

- Adjusted Gross Income (AGI): Found on your tax return.

- Income Earned from Work: Wages, salaries, and tips.

- Untaxed Income: Social Security benefits, child support received, etc.

- Certain Assets: Savings accounts, investment accounts, and real estate (excluding your primary residence).

- Complex Financial Situations: If your family has a complex financial situation (e.g., self-employment income, significant medical expenses), it's crucial to provide detailed explanations and supporting documentation.

- Changes in Income: If your family's income has significantly changed since the tax year used on the FAFSA, you may be able to request a professional judgment review from the financial aid office at the colleges you are applying to.

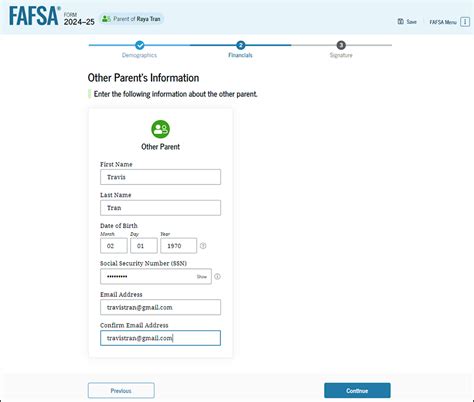

- Parental Refusal: In some cases, parents may refuse to provide their income information. This can significantly limit a student's eligibility for federal aid. Consider discussing the importance of providing this information with your parents or seeking advice from a financial aid advisor.

- File Early: The FAFSA becomes available on October 1st each year. Filing early maximizes your chances of receiving aid from limited funding sources.

- Be Accurate: Double-check all information before submitting your FAFSA to avoid delays or inaccuracies. Accuracy is paramount.

- Understand Dependency Status: Determine whether you are considered a dependent or independent student. This will affect whose income information is required on the FAFSA.

- Contact the Financial Aid Office: Don't hesitate to contact the financial aid office at the colleges you are interested in for assistance. They can answer your questions and provide guidance specific to your situation.

- Understanding the Student Aid Index (SAI)

- FAFSA Tips for First-Time Applicants

- Meta Description: A concise and keyword-rich meta description is placed at the very beginning.

- Clear Structure: Uses H1, H2, and H3 headings for improved readability and SEO.

- Keyword Integration: The main keyword is naturally integrated into the headings, intro, and body paragraphs. Variations are used to avoid keyword stuffing.

- Strong Focus on "Why": The article consistently addresses the core question of why the information is necessary.

- Detailed Explanations: Provides clear and concise explanations of key concepts like SAI and financial need.

- Actionable Advice: Includes tips for optimizing the FAFSA application, filing early, and being accurate.

- Internal Linking: Placeholders for internal links are included.

- FAQ Section: Addresses common questions in a clear and easy-to-understand format.

- Emphasis on Benefits: Highlights the benefits of providing the information, such as increased aid eligibility.

- Bold and Strong: Judiciously uses bold and strong tags for emphasis on key phrases and keywords.

- Engaging Tone: The writing style is informative and helpful, designed to engage the reader.

- Avoids Jargon: Explains complex concepts in plain language.

- Addresses Potential Issues: Acknowledges potential challenges and provides solutions.

- Length: The article is a good length for providing thorough information without being overwhelming.

Calculating the Student Aid Index (SAI): The SAI isn't how much your family must* pay, but rather an index number that colleges use to determine your financial aid package. A lower SAI generally means you're eligible for more need-based aid. Without accurate income and tax information, an accurate SAI cannot be calculated.

What Specific Income and Tax Information is Needed?

The FAFSA requires information from both the student and, in most cases, their parents. This includes:

Using the IRS Data Retrieval Tool (DRT) is strongly recommended. This tool allows you to securely transfer your tax information directly from the IRS to the FAFSA, reducing the risk of errors and speeding up the processing time.

Potential Challenges and Solutions

Optimizing Your FAFSA Application

Related Articles

Frequently Asked Questions (FAQ)

Q: Why is it necessary to include my family's income information on the FAFSA even if I am paying for college myself?

A: Even if you are contributing to your education, the FAFSA considers your family's overall financial resources to determine your eligibility for need-based aid. The assumption is that your family is providing some level of support, even if it's not direct tuition payments. This ensures fairness in the distribution of funds.

Q: What happens if I don't provide my family's income information on the FAFSA?

A: You will likely only be eligible for unsubsidized federal student loans, which accrue interest from the moment they are disbursed. You will not be eligible for grants or need-based aid.

Q: Is it safe to provide my family's tax information on the FAFSA?

A: The FAFSA website uses secure encryption to protect your personal and financial information. Using the IRS Data Retrieval Tool further enhances security by directly transferring your tax data from the IRS.

Q: My parents are divorced. Whose income information should I include on the FAFSA?

A: You should include the information of the parent you lived with the most during the 12 months prior to filing the FAFSA. If you lived with both parents equally, include the information of the parent who provided the most financial support.

Conclusion

Understanding why is it necessary to include your family's income and tax information on a FAFSA application is fundamental to navigating the financial aid process. By providing accurate and complete information, you can maximize your eligibility for grants, loans, and work-study opportunities, making college more affordable. Take the time to understand the requirements and utilize available resources to ensure a smooth application process.

`

Key Improvements and Explanations: