Secure Your Future: Navigating Wealth Management Services

What are Wealth Management Services?

Are you ready to take control of your financial future? Understanding and utilizing wealth management services is the key. This comprehensive guide explores the world of wealth management services, explaining what they are, who they're for, and how they can help you secure your financial well-being. We'll delve into various strategies and explore how to choose the best services for your unique circumstances.

Why Choose Wealth Management Services?

Wealth management services offer a holistic approach to managing your finances, going beyond simple investment advice. They provide a personalized plan tailored to your specific goals, risk tolerance, and financial situation. This personalized approach is crucial, as a one-size-fits-all approach rarely leads to optimal results.

Key Benefits of Wealth Management Services:

- Personalized Financial Planning: Create a comprehensive financial plan encompassing retirement planning, estate planning, tax planning, and education funding.

- Investment Management: Expert portfolio management designed to achieve your financial objectives, taking into account your risk profile.

- Risk Management: Develop strategies to mitigate risks and protect your assets.

- Tax Optimization: Minimize your tax liability through strategic planning and investment choices.

- Estate Planning: Preserve your legacy and ensure the smooth transfer of your assets to your heirs.

- Access to Expertise: Benefit from the knowledge and experience of certified financial planners and investment professionals.

- Your Financial Goals: Define your short-term and long-term financial objectives.

- Risk Tolerance: Assess your comfort level with investment risk.

- Investment Timeline: Determine your investment horizon (short-term, long-term).

- Fees and Charges: Understand the fees associated with different services.

- Reputation and Experience: Research the firm's track record and experience.

Types of Wealth Management Services

Wealth management services encompass a range of offerings, catering to diverse financial needs and goals. Understanding these different service types is crucial in selecting the right fit for you:

1. Financial Planning:

This focuses on creating a long-term strategy to achieve your financial goals. It involves setting objectives, analyzing your current financial situation, and developing a personalized roadmap. This often includes retirement planning, college savings, and estate planning.

2. Investment Management:

This involves the active management of your investment portfolio. Professional wealth managers use various strategies to maximize returns while minimizing risk. This service considers your risk tolerance, investment timeline, and financial objectives.

3. Tax Planning:

This service minimizes your tax burden through strategic financial planning. This may involve tax-efficient investing, tax loss harvesting, and estate planning strategies to reduce tax liabilities.

Choosing the Right Wealth Management Services

Selecting the right wealth management services requires careful consideration of your unique needs and preferences. Here are some key factors to consider:

Frequently Asked Questions (FAQs)

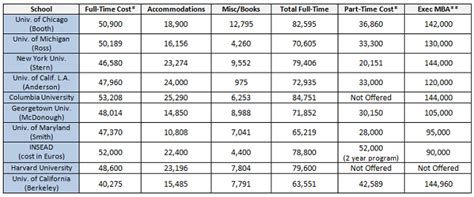

Q: How much do wealth management services cost?

A: The cost of wealth management services varies greatly depending on the services chosen, the assets under management (AUM), and the firm's fee structure. Fees are often based on a percentage of your assets under management or a combination of hourly fees and performance-based fees.

Q: Are wealth management services only for the wealthy?

A: While high-net-worth individuals often utilize these services, wealth management services are available to individuals at all income levels. Many firms offer services tailored to different financial situations and asset levels.

Q: What is the difference between a financial advisor and a wealth manager?

A: While the terms are sometimes used interchangeably, a financial advisor typically provides broader financial advice, whereas a wealth manager offers a more comprehensive and holistic approach to managing your assets and financial well-being. A wealth manager often has a larger team supporting their clients and deeper expertise in diverse areas like estate planning and tax optimization.

Q: How do I find a reputable wealth management firm?

A: Thorough research is crucial. Look for firms with a strong track record, experienced professionals, and a transparent fee structure. Check for certifications and affiliations, such as Certified Financial Planner (CFP) designations. Seek referrals from trusted sources and conduct interviews with multiple firms before making a decision.

By understanding the benefits and options available within wealth management services, you can empower yourself to make informed decisions and secure a brighter financial future. Remember to always conduct thorough research and choose a firm that aligns with your individual needs and goals.