Nvidia Share Price: Understanding the Factors Driving its Value

`markdown

Preview: Nvidia's stock has been a major talking point in the financial world. This article delves into the key factors influencing the Nvidia share price, providing insights for investors and those interested in the technology market.

Understanding the Dynamics of Nvidia Share Price

The Nvidia share price has experienced significant volatility and growth in recent years, primarily fueled by its dominant position in key technology sectors. Understanding the factors contributing to these fluctuations is crucial for investors and industry observers alike. This article provides an in-depth analysis of these drivers.

Factors Influencing Nvidia's Stock Performance

Several key factors exert a strong influence on the Nvidia share price. These include:

- Demand for GPUs: Nvidia's GPUs are essential for a wide range of applications, including gaming, data centers, and artificial intelligence (AI). Strong demand in these areas directly impacts the company's revenue and, consequently, its stock price.

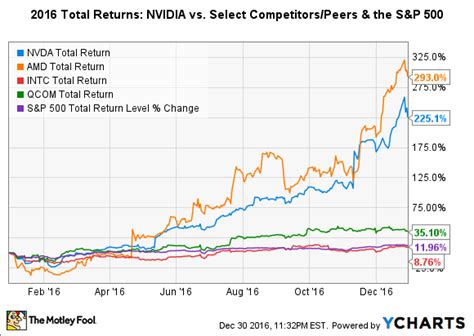

- Competition: Competition from other chipmakers, such as AMD and Intel, can affect Nvidia's market share and profitability, influencing investor sentiment.

- Financial Performance: Nvidia's quarterly and annual earnings reports are closely watched by investors. Strong financial results, including revenue growth and profitability, typically lead to an increase in the stock price.

- Macroeconomic Factors: Broader economic conditions, such as interest rates and inflation, can also influence investor sentiment and the overall stock market, affecting Nvidia's stock.

AI Boom: The explosive growth of AI has been a major catalyst for Nvidia. Its GPUs are the de facto* standard for training and deploying AI models, making the company a central beneficiary of this trend.

Supply Chain Issues: Disruptions in the global supply chain can impact Nvidia's ability to meet demand, potentially leading to lower revenue and a drop in the Nvidia share price*.

Analyzing Recent Trends in Nvidia Share Price

Recent trends show a significant uptrend in the Nvidia share price driven by the aforementioned factors, particularly the AI boom. The company's strategic partnerships and technological advancements in AI have solidified its position as a leader in the industry. However, volatility remains a concern, and investors should carefully consider the risks before investing.

The Future Outlook for Nvidia Stock

Predicting the future of the Nvidia share price is challenging, but several factors suggest continued growth potential. The demand for AI is expected to remain strong in the coming years, and Nvidia is well-positioned to capitalize on this trend. However, increased competition and potential regulatory scrutiny could pose challenges. Investors should conduct thorough research and consider their risk tolerance before investing in Nvidia stock.

Optimizing Investment Strategies with Nvidia Shares

Investing in Nvidia share price demands a nuanced strategy. Diversification is key to mitigate sector-specific risks. Monitor market trends, technological advancements, and competitive pressures to make informed investment decisions. Regularly review and rebalance your portfolio to align with your financial goals and risk appetite. Consult a financial advisor for personalized guidance.

Conclusion: Navigating the Nvidia Share Price Landscape

The Nvidia share price is influenced by a complex interplay of factors, including technological innovation, market demand, and macroeconomic conditions. By understanding these drivers, investors can make more informed decisions about investing in Nvidia stock. Continuous monitoring and adapting to the evolving market dynamics are essential for successful long-term investment.

Frequently Asked Questions (FAQ) about Nvidia Share Price

Q: What is driving the current high price of Nvidia shares?

A: The primary driver is the surging demand for Nvidia's GPUs in artificial intelligence (AI) applications. Nvidia's chips are the de facto standard for AI model training and deployment, leading to significant revenue growth and increased investor confidence in the Nvidia share price.

Q: How does competition affect Nvidia's stock?

A: Competition from companies like AMD and Intel can put pressure on Nvidia's market share and pricing, potentially impacting its profitability. Increased competition can lead to volatility in the Nvidia share price.

Q: Is Nvidia stock a good long-term investment?

A: While there are no guarantees, many analysts believe that Nvidia has strong long-term growth potential due to the continued expansion of AI and other high-performance computing applications. However, investors should carefully consider their risk tolerance and diversify their portfolios.

Q: What are the risks associated with investing in Nvidia stock?

A: Risks include increased competition, potential regulatory scrutiny, supply chain disruptions, and broader economic downturns. These factors could negatively impact Nvidia's financial performance and the Nvidia share price.

Q: How can I stay informed about changes in the Nvidia share price?

A: You can track the Nvidia share price on financial websites, news outlets, and brokerage platforms. It's also important to follow the company's earnings reports and industry news to understand the factors driving its performance.

`