Decoding the VZ Stock Price: Trends, Analysis, and Future Outlook

Okay, let's craft some compelling content focused on "vz stock price" while keeping all your SEO and human-focused guidelines in mind.

`markdown

Preview: Interested in the vz stock price and its future trajectory? This article dives deep into recent trends, provides detailed analysis, and explores potential factors influencing Verizon's stock performance, offering valuable insights for investors. We'll examine key metrics, market influences, and provide a comprehensive overview to help you understand the vz stock price better.

Understanding the VZ Stock Price: A Deep Dive

The vz stock price is a key indicator of Verizon Communication's financial health and investor confidence. Tracking its movement requires an understanding of various factors, from the overall market conditions to company-specific performance. This section will break down the recent trends and influences on the vz stock price.

Recent Trends in VZ Stock Price

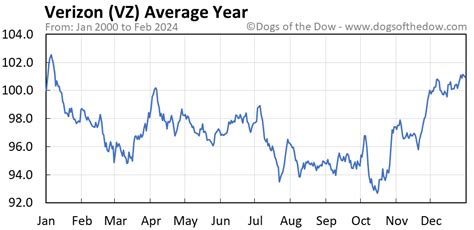

Analyzing historical data is crucial for understanding the current vz stock price. Over the past year, the price has experienced fluctuations due to factors like:

- Market Volatility: General economic uncertainty and market corrections.

- Earnings Reports: Verizon's quarterly and annual financial results.

- Industry News: Developments in the telecommunications sector, including competition and regulatory changes.

- Dividend Yield: As Verizon is known to be a dividend stock, its dividend yield can affect investor interest.

- Financial Performance: Revenue growth, profitability, and debt management.

- Subscriber Growth: Adding and retaining customers in the competitive wireless and broadband markets.

- 5G Rollout: The progress and impact of Verizon's 5G network deployment.

- Capital Expenditures: Investments in infrastructure and technology.

- Interest Rate Changes: As Verizon is a dividend stock, the change in the risk-free rate will change how investors value the dividend.

- Revenue: Indicates the company's ability to generate sales.

- Earnings Per Share (EPS): Measures profitability on a per-share basis.

- Debt-to-Equity Ratio: Assesses the company's financial leverage.

- Free Cash Flow: Represents the cash available to the company after operating expenses and capital expenditures.

- 5G Adoption: Continued growth in 5G subscribers and related services.

- Expansion into New Markets: Opportunities in areas like IoT (Internet of Things) and enterprise solutions.

- Competition: Intense competition from other telecommunications companies.

- Regulatory Environment: Potential changes in regulations affecting the industry.

- Economic Conditions: Broad economic factors that could impact consumer spending and business investment.

It's important to monitor these trends to identify potential patterns and inform investment decisions. The vz stock price is continuously influenced by these forces.

Key Factors Influencing the VZ Stock Price

Several factors contribute to the movement of the vz stock price. These include:

Understanding these factors helps investors assess the fundamental value of Verizon and its potential for future growth, impacting the vz stock price.

Analyzing Verizon's Financial Health and its Impact on VZ Stock Price

A comprehensive analysis of Verizon's financial health is essential for predicting future movements in the vz stock price.

Key Financial Metrics to Watch

Investors should pay close attention to the following metrics:

These metrics provide insights into Verizon's financial stability and growth potential, which directly influences the vz stock price.

The Impact of Verizon's Dividends on VZ Stock Price

Verizon is known for its consistent dividend payments, which can attract income-seeking investors. Changes in the dividend policy or yield can significantly impact the vz stock price. A higher dividend yield often makes the stock more attractive, while a dividend cut can lead to a price decline.

Future Outlook and Predictions for VZ Stock Price

Predicting the future vz stock price is challenging, but several analysts offer forecasts based on various factors.

Expert Opinions and Analyst Ratings

Analyst ratings can provide valuable insights into the potential future performance of the vz stock price. These ratings are based on in-depth research and analysis of the company's financials, industry trends, and competitive landscape. However, remember that these are just predictions and not guarantees.

Potential Growth Drivers and Challenges

Looking ahead, the vz stock price will be influenced by:

By carefully monitoring these factors, investors can make more informed decisions about their investments in Verizon and its stock, the vz stock price.

[Internal Link to a relevant older post about investing in telecom stocks]

VZ Stock Price: Frequently Asked Questions (FAQ)

Q: What factors primarily influence the VZ stock price?

A: The vz stock price is primarily influenced by Verizon's financial performance, subscriber growth, 5G rollout progress, market volatility, and dividend policy.

Q: Is Verizon a good dividend stock?

A: Verizon is known for its consistent dividend payments, which can attract income-seeking investors. However, investors should consider the sustainability of the dividend and the company's overall financial health before investing.

Q: Where can I find the latest VZ stock price information?

A: You can find the latest vz stock price on major financial websites like Yahoo Finance, Google Finance, and Bloomberg.

Q: What is the future outlook for Verizon and its stock?

A: The future outlook for Verizon and its stock depends on factors like 5G adoption, expansion into new markets, competition, and regulatory environment. Analyst ratings and expert opinions can provide additional insights. Investors should follow the news surrounding the VZ stock price.

Q: How does the overall economy affect the VZ stock price?

A: Economic downturns or upturns can significantly impact the vz stock price. A strong economy typically leads to increased consumer spending and business investment, which can benefit Verizon. Conversely, a recession can negatively affect the stock.

Conclusion: The vz stock price is a complex reflection of Verizon's business and the broader market. By understanding the key drivers and trends, investors can make more informed decisions about whether to invest in this telecommunications giant.

`