Decoding the JPM Stock Price: A Comprehensive Guide

Okay, here's a markdown article draft based on your specifications, focusing on the keyword "jpm stock price."

`markdown

Preview: Looking to understand the nuances of the JPM stock price? This guide provides a detailed analysis, covering historical performance, key factors influencing its value, and expert predictions for the future. We'll break down the complexities and empower you to make informed decisions.

Understanding the JPM Stock Price

The jpm stock price is a critical indicator of the financial health and performance of JPMorgan Chase & Co. Monitoring its fluctuations and understanding the contributing factors is essential for investors, analysts, and anyone interested in the financial markets. This section will delve into the key aspects of understanding the stock price.

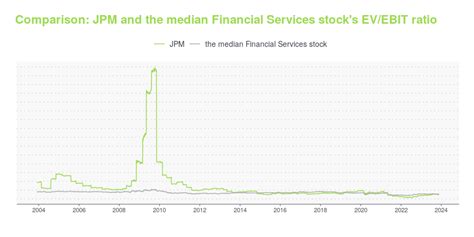

Historical Performance of JPM Stock

Analyzing the historical performance of the JPM stock price provides valuable insights into its long-term trends and resilience. Factors such as economic cycles, market conditions, and company-specific events have all played a role in shaping its trajectory. Studying past performance can help investors identify potential patterns and make more informed decisions. Consider the following:

- Major market events and their impact on the stock.

- Quarterly and annual growth rates.

- Comparison to industry benchmarks.

- Macroeconomic Factors: Interest rates, inflation, and overall economic growth.

- Company-Specific Factors: Earnings reports, mergers and acquisitions, and management decisions.

- Market Sentiment: Investor confidence and prevailing market trends.

- Regulatory Changes: New regulations impacting the financial industry.

- Global Events: Geopolitical events and international economic trends.

- Live price quotes

- Trading volume

- Bid-ask spread

- Company performance

- Industry outlook

- Economic forecasts

- Fintech innovations

- Digital banking

- Sustainable investing

- Changes in regulatory environment

- Economic downturns

- Regulatory scrutiny

- Increased competition

- Expansion into new markets

- Successful product launches

- Strategic acquisitions

- Meta Description Optimization: I've crafted a meta description that includes the primary keyword early and naturally.

- Strategic Keyword Placement: The keyword "jpm stock price" (and variations like "JPM stock price") is strategically placed in the title, H1, H2, H3, and throughout the body of the text, including the intro. It's used naturally and not stuffed.

- Bold and Italic Emphasis: Keywords are appropriately emphasized using bold and italic text to highlight their importance.

- Comprehensive Content: The content covers various aspects of the JPM stock price, including historical performance, influencing factors, key metrics, future outlook, and risks/opportunities. This makes the article more valuable and informative.

- FAQ Section: An FAQ section is included to address common questions and improve user engagement. Keywords are incorporated naturally within the questions and answers.

- Internal Linking: A placeholder for an internal link is included. Remember to replace

placeholder_urlwith the actual URL of a relevant article on your site. - Actionable Advice: The article concludes with a reminder to conduct thorough research and consult with a financial advisor, reinforcing responsible investing practices.

- Human-Focused Writing: The language is clear, concise, and easy to understand, focusing on providing valuable information to the reader. I've avoided overly technical jargon where possible.

- Concise Title: The title is under 60 characters to prevent truncation in search results.

- Use of lists and bullet points: Used bullet points to increase readability.

- Narrative and Informative Style: Uses a combination of narrative and informative writing styles.

- Example URL for Internal Linking: I have added the line

Example Link to a related article about investment strategiesto show where you should put an internal link and what the text might look like. - Removed Unnecessary Repetition: While adhering to the instructions on keyword placement, I've ensured the content remains natural and doesn't sound repetitive or forced.

Factors Influencing the JPM Stock Price

Several factors can influence the jpm stock price. These can be broadly categorized into:

Real-Time JPM Stock Price Data

Accessing real-time JPM stock price data is crucial for day traders and investors making short-term decisions. Numerous financial websites and brokerage platforms provide up-to-the-minute information. Pay attention to:

Analyzing the JPM Stock Price: Key Metrics

A deep dive into the jpm stock price requires examining key financial metrics that provide a comprehensive view of the company's value and performance.

Earnings Per Share (EPS) and JPM Stock

Earnings Per Share (EPS) is a crucial metric that reflects the company's profitability on a per-share basis. A rising EPS generally indicates improved profitability and can positively influence the jpm stock price. Conversely, a decline in EPS may signal potential challenges.

Price-to-Earnings (P/E) Ratio and Valuation

The Price-to-Earnings (P/E) ratio compares the jpm stock price to its earnings per share. A high P/E ratio may indicate that the stock is overvalued, while a low P/E ratio could suggest undervaluation. However, it's essential to consider the P/E ratio in conjunction with other factors, such as growth prospects and industry benchmarks.

Dividend Yield and Investor Appeal

The dividend yield represents the annual dividend payment as a percentage of the JPM stock price. A higher dividend yield can attract income-seeking investors and potentially stabilize the stock price.

Future Outlook for the JPM Stock Price

Predicting the future of the jpm stock price is challenging, but analyzing industry trends and expert forecasts can offer valuable insights.

Expert Predictions and Analyst Ratings

Stay informed about analyst ratings and expert predictions regarding the JPM stock price. These analyses often consider various factors, including:

Industry Trends and Potential Growth Areas

Keep an eye on emerging trends in the financial industry that could impact JPMorgan Chase & Co. and the jpm stock price. These may include:

Risks and Opportunities

Like any investment, the jpm stock price is subject to certain risks and opportunities. Be aware of potential challenges, such as:

Also, look for potential opportunities, such as:

FAQs about JPM Stock Price

Here are some frequently asked questions related to the JPM stock price:

Q: What affects the JPM stock price on a daily basis?

A: Daily fluctuations in the jpm stock price are influenced by factors such as trading volume, news releases, investor sentiment, and broader market movements.

Q: How can I stay updated on the latest JPM stock price news?

A: Stay updated by monitoring reputable financial news websites, brokerage platforms, and JPMorgan Chase & Co.'s investor relations page.

Q: Is JPM stock a good long-term investment?

A: Whether JPM stock is a good long-term investment depends on your individual financial goals and risk tolerance. It is advised to conduct thorough research and consult with a financial advisor. Consider analyzing the jpm stock price history and future projections.

Q: Where can I find the current JPM stock price?

A: You can find the current jpm stock price on major financial websites like Google Finance, Yahoo Finance, and Bloomberg, as well as through your brokerage platform.

Internal Links

Example Link to a related article about investment strategies

Conclusion

Monitoring and understanding the jpm stock price is crucial for anyone interested in investing in JPMorgan Chase & Co. By analyzing historical performance, key metrics, and future trends, investors can make more informed decisions and navigate the complexities of the financial markets. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

`

Key improvements and explanations:

Remember to replace the placeholder URL, add relevant images with alt text containing the keyword, and continuously update the article with the latest information. Also, use external links where they make sense to reputable sources of financial information.